Current Ratio Benchmark by Industry

We saw annual rates as high as 130 in 2020. A current ratio that is above the industry average or in line with it is generally considered healthy.

Industry Average Financial Ratios For Manufacturing For Years 2018 And 2017 Download Scientific Diagram

Current ratio indicates whether the bank has enough cash and cash-equivalents to meet its short-term liabilities for a specific time frame usually one year.

. Acceptable current ratios vary from industry to industry. 4190 year 2021 Ratio. Its called current since it refers to all current assets and liabilities.

Listed companies included in the calculation. Or manually enter accounting data for industry benchmarking Retail Trade. In the given case the industry benchmark is 2.

22 rows All Industries. Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current liabilities. Quick Ratio - breakdown by industry.

The current ratio also known as working capital ratio is a financial performance measure of company liquidity. Current Ratio Measure of center. If a companys current ratio is very high compared to its peers it can depict that the management may not be using its assets lucratively or efficiently.

Our biggest outliers come from the bottom of the list. Its a comfortable financial position for most enterprises. This article aims to study the.

This metric indicates a companys ability to meet short-term debt obligations by measuring whether or not a firm has enough resources to pay its debts over the next 12 months. Retail is an industry that is expected to generate cash on a day-to-day basis and its easy for lenders to get. Dun Bradstreets Key Business Ratios provides online access to benchmarking data.

The online version of the RMA Annual Statement Studies includes financial ratio benchmarks as well as industry default probabilities and cash flow measures. The Average Current Ratio for Retail Industry. Cash Ratio - breakdown by industry.

The Average Current Ratio for Airline Industry. Cash and cash equivalents Current Liabilities. Make Calculated Informed Decisions Based On Award-Winning Market Research And Analysis.

More about current ratio. What the Ratios Tell. 75 rows The current ratio indicates a companys ability to meet short-term debt obligations.

Current Assets - Inventories Current Liabilities. Or manually enter accounting data for industry benchmarking Manufacturing. G - Retail Trade Measure of center.

It can also give a sense of the efficiency of a companys. The mostly known benchmark measure for any financial ratio is industry. Current Assets Current Liabilities.

Measures how well you can cover current liabilities with. Median recommended average Financial ratio. Average values for the ratio you can find in our industry benchmarking reference.

Tests for solvency or ability to meet current debt obligations. Average industry financial ratios for US. Listed companies included in the calculation.

The current ratio is a widely used metric in financial analysis. Its also referred to as the working capital ratio or acid test ratio. Ad Stay At The Forefront Of Your Industry With Mintel Market Reports.

Its especially helpful for the businesses lenders that assessability of the business to repay their dues. Commonly acceptable current ratio is 2. Financial performance of a specific company based on financial ratios is very often assessed related to some benchmark.

More about cash ratio. Average industry financial ratios for US. Listed companies included in the calculation.

RMA provides balance sheet and income statement data and financial ratios compiled from financial statements of more than 240000 commercial borrowers classified into three income brackets in over 730 different industry categories. The bankers will look at these industry benchmarks as they assess your stores performance. More about quick ratio.

Leisure and Hospitality which includes the casual food service industry comes in at 849. The current ratio is an essential financial matric that helps to understand the liquidity structure of the business. On the other end of the spectrum with a turnover rate of 18 are government positions illustrating why theyre known for their job security.

It compares current assets with the current liability to assess if the business has sufficient liquid funds. D - Manufacturing Measure of center. A current ratio below the industry average may indicate an increased risk of financial suffering or default.

All Industries Measure of center. Average industry financial ratios for US. Statistics are derived from data submitted by bank members of the Risk Management Association.

Current Ratio Current Assets divided by Current Liabilities. If current assets of the business exceed current liability the liquidity is assessed to be in good shape and vice versa. For most industrial companies 15 may be an acceptable current ratio.

The data comes from more than 260000 statements of public and private companies but the vast. Current ratio indicates the liquidity of a company and whether it is able to repay its short term obligations in a timely mannerA higher current ratio above 2 is generally deemed favorable but a very high current ratio is not necessarily good because it means the company is not able to use its current assets appropriately. The quick ratio is a measure of a companys ability to meet its short-term obligations using its most liquid assets near cash or quick assets.

2021 Social Media Benchmarks Facebook Instagram Twitter Statusbrew

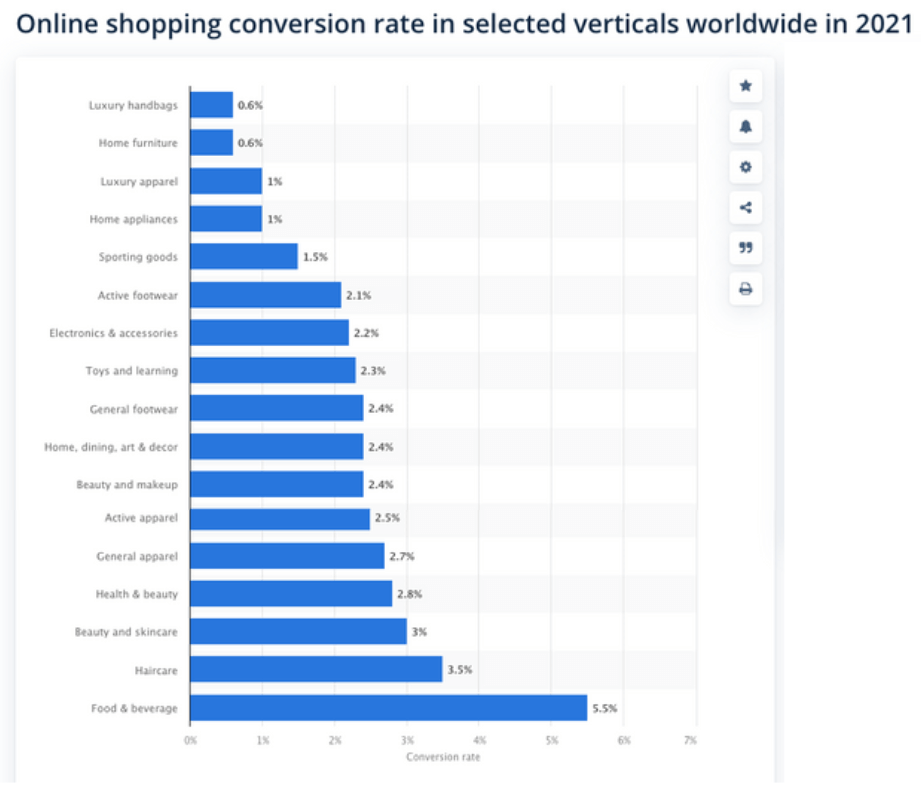

E Commerce Conversion Rates Benchmarks 2022 How Do Yours Compare

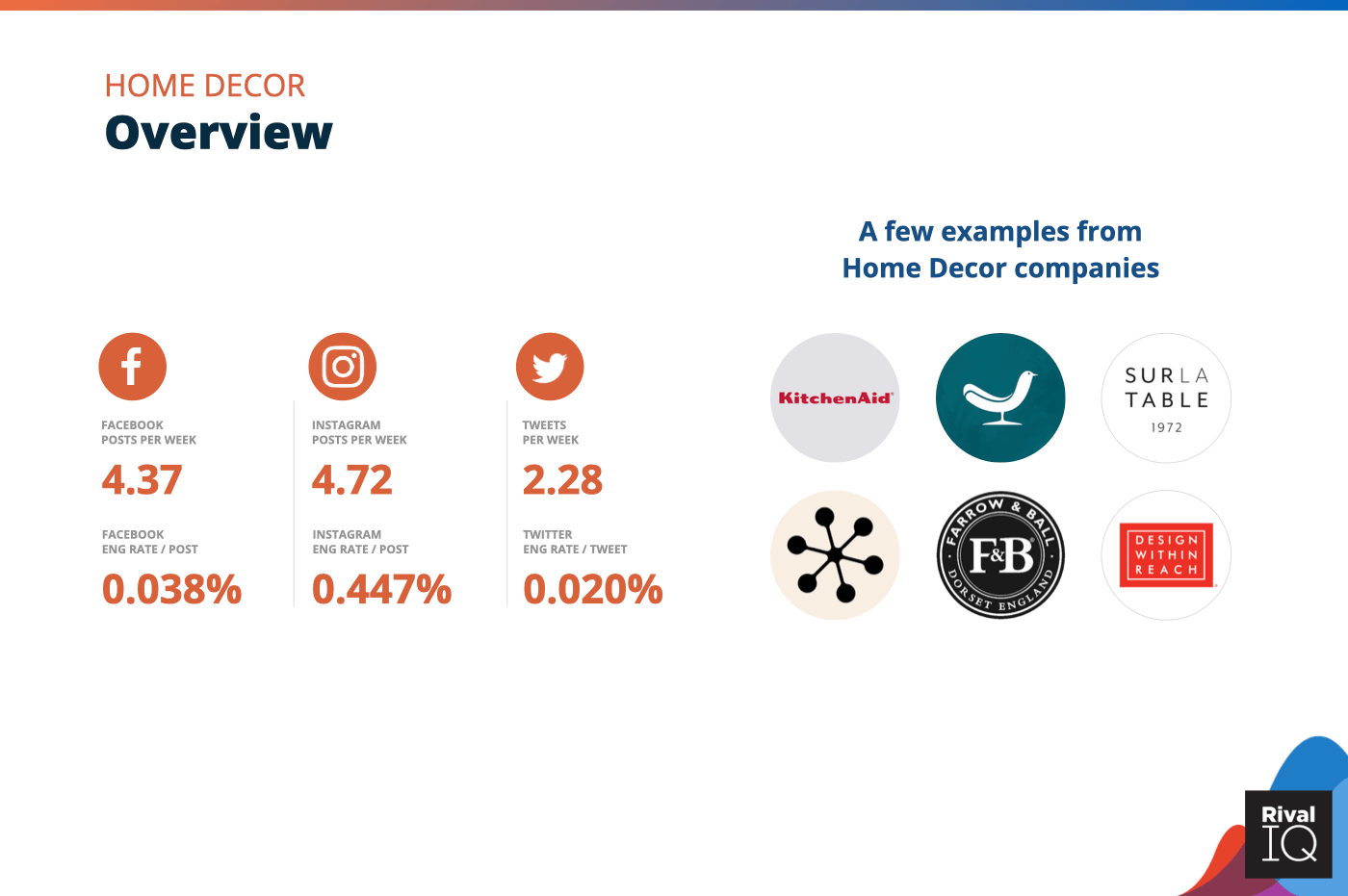

2022 Social Media Industry Benchmark Report Rival Iq

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

2021 Social Media Benchmarks Facebook Instagram Twitter Statusbrew

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Comments

Post a Comment